How to calculate Net Realizable Value NRV Leave a comment

By embracing technological advancements, businesses can stay ahead in an ever-evolving market and ensure their financial practices are robust and forward-thinking. It’s the selling price of an asset less the total cost of selling the asset. Net realizable value can also refer net realizable value to the aggregate total of the ending balances in the trade accounts receivable account and the offsetting allowance for doubtful accounts. This net amount represents the amount of cash that management expects to realize once it collects all outstanding accounts receivable.

Fixed Assets Liabilities

Then we must track the calculation in a spreadsheet and track sold finished goods and materials that went to production. This is crucial, as when we sell an item, we have to write-off its cost and its NRV allowance. A high NRV indicates that a company expects to collect a significant portion of its receivables, suggesting effective credit policies and collection efforts. A low NRV could imply potential difficulties in collecting receivables, which could impact cash flow and profitability.

How do I calculate net assets?

In contrast, revenues can only be recorded when they are assured of being received. Included in cost of goods sold for the years ended June 30, 2019, and 2018, are inventory write-offs of $0 and $692,000, respectively. The write-offs reflect inventories related to discontinued product lines, excess repair parts, product rejected for quality standards, and other non-performing inventories. Applying LCNRV to total inventory gave us a NRV of $274,610 (see Inventory List in prior reading) which was higher than total cost, so there would be no adjustment necessary. We just left each inventory item listed at cost, even though some of the items had an NRV less than cost (first column).

What is the net realizable value for Inventory?

There is an ongoing need to examine the value of inventory to see if its recorded cost should be reduced, due to the negative impacts of such factors as damage, spoilage, obsolescence, and reduced demand from customers. Further, writing down inventory prevents a business from carrying forward any losses for recognition in a future period. Thus, the use of net realizable value is a way to enforce the conservative recordation of inventory asset values.

For instance, if a building’s original cost is reduced by depreciation, the remaining value is part of net assets. It allows users to extract and ingest data automatically, and use formulas on the data to process and transform it. Finished goods inventories are stated at the lower of standard cost, which approximates actual cost using the first-in, first-out method, or net realizable value.

Accounting Records

Net realizable value for inventory is the estimated selling price of inventory in the ordinary course of business, minus the estimated costs of completion and sale. For instance, if inventory sells for $500 and costs $100 to complete and sell, the NRV is $400, reflecting the inventory’s true market value. The total production and selling costs are the expenses required to facilitate the trade.

Accounting for Net Realizable Value

The second is the aging of receivables method, in which receivables are categorized based on their age, and different percentages are applied to each category based on the likelihood of collection. To calculate the sale price per unit for the non-defective units, only the selling costs need to be deducted, which comes out to $55.00. The NRV of the defective Inventory is the product of the number of defective units and the sale price per unit after the repair and selling costs. According to the notion of lesser cost or net realizable value, inventory should be recorded at the lower of its cost or the price at which it can be sold. The estimated selling price of something in the regular course of business, less the completion, selling, and shipping costs, is known as the net realizable value. Other times NRV is used by accountants to make sure an asset’s value isn’t overstated on the balance sheet.

- Companies rely on past experience to estimate an average percentage of their A/R that is uncollectible.

- As evidenced above, net realizable value is a vital tool for making informed decisions about the performance of your accounts receivables and the value of assets and your inventory.

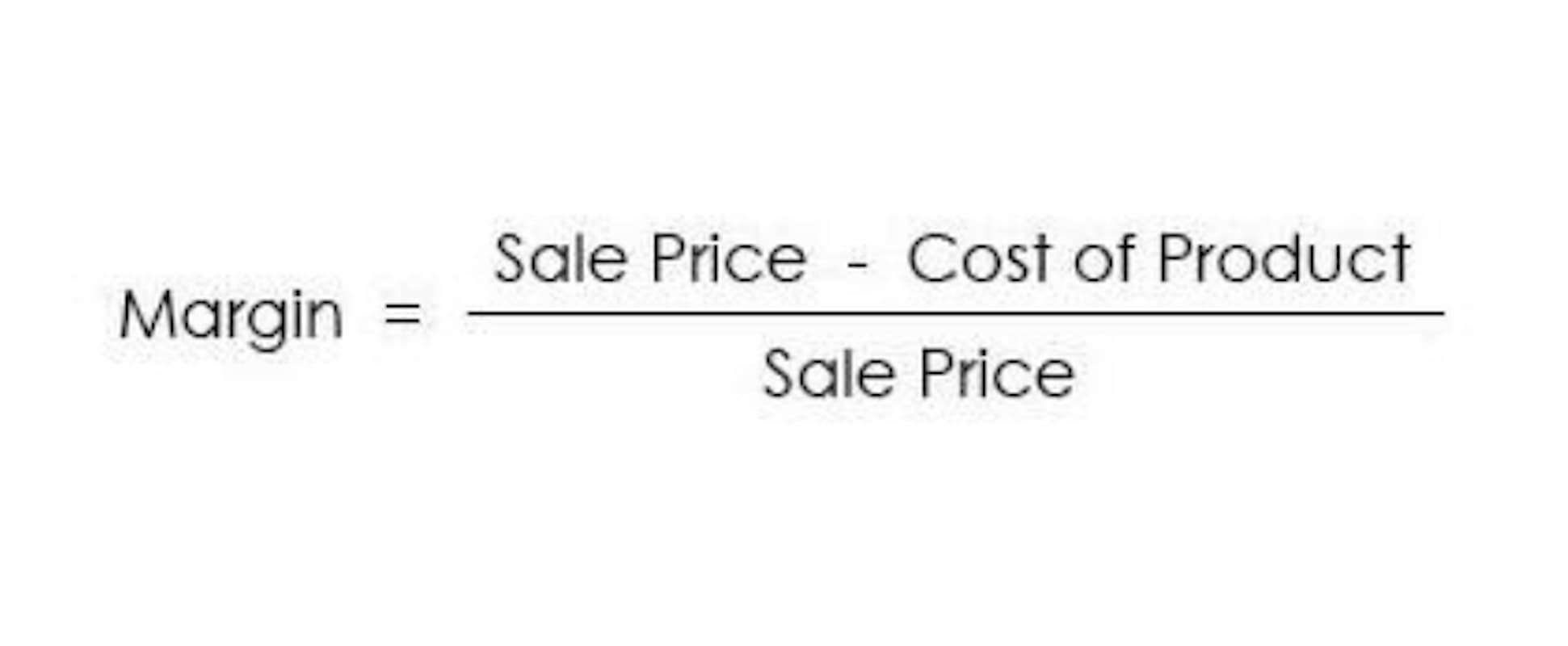

- The formula for calculating net realizable value (NRV) is the difference between the expected sale price and the total sale or disposal costs.

- It’s the selling price of an asset less the total cost of selling the asset.

- NRV is a conservative approach to accounting, which is in line with the principle of conservatism.

- This means that you do not need to use a net realizable value calculator in order to gain access to this vital information.

- We have helped accounting teams from around the globe with month-end closing, reconciliations, journal entry management, intercompany accounting, and financial reporting.

What are Net Fixed Assets?

In fact, the net realizable value formula is divided into just three steps. NRV is also used to account for costs when two products are produced together in a joint costing system until the products reach a split-off point. Each product is then produced separately after the split-off point, and NRV is used to allocate previous joint costs to each of the products. Depending on the industry the company is it, the company may decide to accept a certain amount of uncollectable sales. The company may also lack the resources to pursue delinquent receivables.

Calculating Net Realizable Value for Accounts Receivable

Accounting standards (IRFS and US GAAP) require that we apply a conservatism principle when we assess the value of assets and transactions. These factors influence the estimation of the ADA, which directly impacts NRV. This ensures that your financial statements provide a true and fair view of your financial position. For instance, if the ADA is consistently increasing, it may signal a need to reassess collection strategies. This is the total amount owed to your company by customers for goods or services sold on credit and is the total amount of your outstanding invoices.